Usually, direct labor rate variance does not occur due to change in labor rates because they are normally pretty easy to predict. A common reason of unfavorable labor rate variance is an inappropriate/inefficient use of direct labor workers by production supervisors. At first glance, the responsibility of any unfavorable direct labor efficiency variance lies with the production supervisors and/or foremen because they are generally the persons in charge of using direct labor force. However, it may also occur due to substandard or low quality direct materials which require more time to handle and process. If direct materials is the cause of adverse variance, then purchase manager should bear the responsibility for his negligence in acquiring the right materials for his factory. Understanding labor efficiency variance helps companies identify inefficiencies in their production processes and take corrective actions to improve labor productivity.

Direct Labor Yield Variance FAQs

Our Spending Variance is the sum of those two numbers, so $6,560 unfavorable ($27,060 − $20,500). For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the 100 printable invoice templates past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University.

How Liam Passed His CPA Exams by Tweaking His Study Process

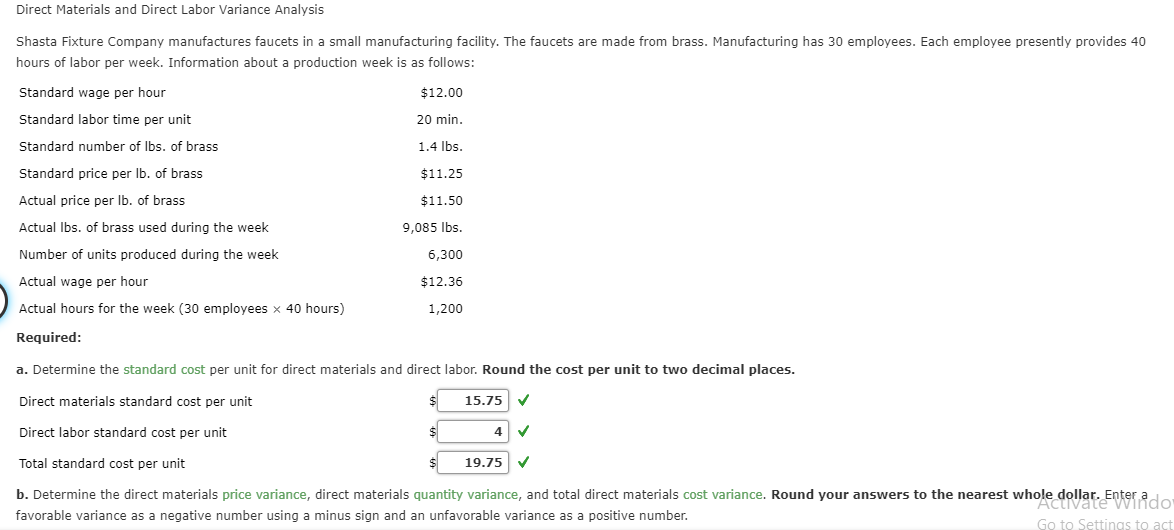

There are two components to a labor variance, the direct labor rate variance and the direct labor time variance. Figure 10.43 shows the connection between the direct labor rate variance and direct labor time variance to total direct labor variance. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor.

7 Direct Labor Variances

Background Company A, a mid-sized manufacturing firm, experienced significant fluctuations in its labor costs over several quarters. Upon analyzing their financial statements, management identified a persistent unfavorable labor rate variance. This results in an unfavorable labor rate variance of $2,000, indicating that the company spent $2,000 more on labor than anticipated due to higher wage rates.

- Since the actual labor rate is lower than the standard rate, the variance is positive and thus favorable.

- The reason is that the highly experienced workers can generally be hired only at expensive wage rates.

- Embracing these practices ensures that labor variance management becomes an integral part of the company’s operational strategy, contributing to its growth and profitability.

- As with direct materials variances, you can use either formulas or a diagram to compute direct labor variances.

Would you prefer to work with a financial professional remotely or in-person?

In situations where goods are produced in small volume or on a customized basis, there may be little point in tracking this variance, since the work environment makes it difficult to create standards or reduce labor costs. Calculating DLYV can help organizations better control their labor costs, optimize production processes, and improve overall profitability. It also provides insights into the effectiveness of human resource management initiatives.

Examples include salaries of supervisors, janitors, and security guards. As mentioned earlier, the cause of one variance might influenceanother variance. For example, many of the explanations shown inFigure 10.7 might also apply to the favorable materials quantityvariance.

The labor efficiency variance calculation presented previouslyshows that 18,900 in actual hours worked is lower than the 21,000budgeted hours. Clearly, this is favorable since theactual hours worked was lower than the expected (budgeted)hours. Before we take a look at the direct labor efficiency variance, let’s check your understanding of the cost variance. Outcome By addressing these issues, Company A was able to reduce its unfavorable labor rate variance significantly in subsequent quarters, achieving better cost control and financial stability. The following equations summarize the calculations for direct labor cost variance. In addition, the difference between the actual and standard rates sometimes simply means that there has been a change in the general wage rates in the industry.

If anything, they try to produce a favorable variance by seeing more patients in a quicker time frame to maximize their compensation potential. The combination of the two variances can produce one overall total direct labor cost variance. Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate. Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output. By understanding the causes of labor variances and implementing targeted corrective actions, companies can enhance labor cost control, improve efficiency, and boost overall productivity.